taxes on fanduel winnings|Understanding Fanduel Earnings Taxes: Common FAQs Answered : Tuguegarao Learn how to report your FanDuel winnings on your taxes, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how .

William Hill Review Bethard Review Mr Green Sport Review . Asian Handicap betting. The term “Asian Handicap” originated in 1998 when an Indonesian bookmaker asked a journalist, Joe Smith, to give a translation of a popular Asian betting method known as ”hang cheng” betting. Today, it is known all over the world as Asian .

taxes on fanduel winnings,We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit paA Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit pa

FanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing . Tingnan ang higit pataxes on fanduel winnings Understanding Fanduel Earnings Taxes: Common FAQs AnsweredFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced . Tingnan ang higit pa Learn how to report your FanDuel winnings on your taxes, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how .taxes on fanduel winnings But whether you're wagering on the World Series from your couch or flying to Las Vegas for a weekend at the tables, you'll have to pay taxes on your winnings.

Firstly, it’s important to know that Fanduel follows federal guidelines when it comes to winnings. If you rake in more than $600 in a calendar year, they’ll send you a .

Sam McQuillan. Updated: Apr 05, 2022, 09:05 AM EDT. Download App. With two weeks left before the deadline to file your federal income taxes for 2022, Action Network's Sam McQuillan sat down with Richard .Understanding Fanduel Earnings Taxes: Common FAQs Answered Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a .Generally, any income received from gambling, including winnings from casinos, lotteries, sports betting, and online platforms like FanDuel, is considered taxable. The IRS .

TVG - Taxes, W2-Gs & Year End Reports. Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in .You can also customize and view certain months throughout the years or by app and product. This statement is not a tax document. You can read much more about taxes and FanDuel by clicking here. There's even . It depends on how much you win. By law, you must report any sports betting winnings as income on your federal tax return. But that gambling-related income is only . The IRS requires gambling operators to withhold 24% of winnings for any wager that exceeds $5,000 and is at least 300 times the amount of the wager. This is known as a “backup withholding” requirement. For example, if you place a $10 bet and win $5,000, FanDuel will withhold $1,200 (24% of $5,000) and send it to the IRS on your behalf.If you won the money (even if you didn’t withdraw), legally you should be showing your net winnings on your tax return somewhere. I don’t know what amounts trigger forms to you and the IRS from FD/DK but legally you owe the tax. Look up the concept of “constructive receipt”. 2. Reply. Major fantasy sports sites and apps (DraftKings, FanDuel, BetMGM, etc.) have an obligation to send winners IRS Form 1099-MISC which contains all the information they need to report fantasy sports .

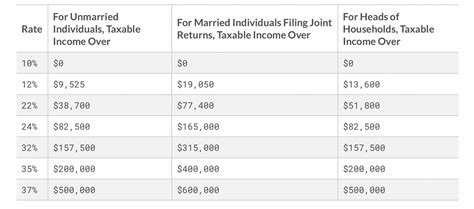

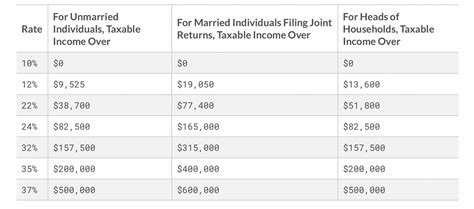

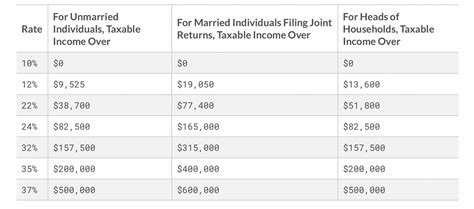

Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I.. There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for .

You will see these options available in the upper right-hand corner of the individual W2-Gs & Year End Reports page (s). Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website to access the W2-Gs & Year-End Reports.

In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall Street Journal tax reporter Laura Saunders joins host J.R. Whal. Every time bettors lose a $1,100 bet, they lose $1,100. But every time sportsbooks lose a $1,100 bet, they only lose $1,000. So if a bettor makes 10 wagers of $1,100 each and goes 5-5 on those .

taxes on fanduel winnings|Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH0 · Where can I see my Win/Loss or Player Activity

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · Taxes

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Sports Betting Taxes: How They Work, What's Taxable

PH7 · How to Pay Taxes on Sports Betting Winnings

PH8 · How Much Taxes Do You Pay On Sports Betting?

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Do I Have To Report FanDuel Winnings On Taxes?